Friends, in today’s life there is no telling when death will come. That is why it has become very important for us to save something for our children. At such times, many people take life insurance to provide some financial support to their family members after their retirement. So what is the best term insurance for your family’s future today? At what age should it start? What are the benefits of insurance? We will know all the information etc.

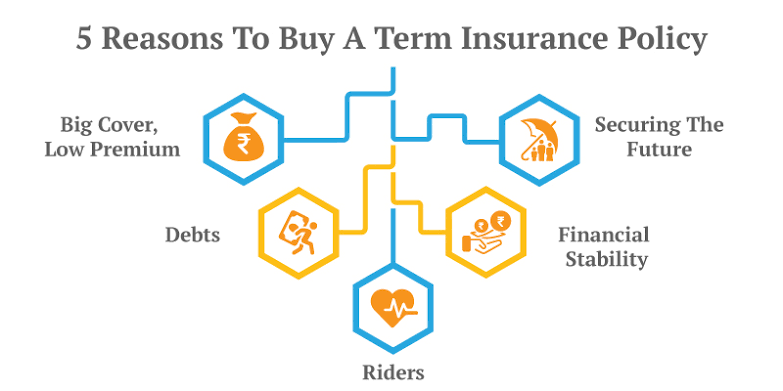

To understand term life insurance, it is important to know that it is a type of life insurance that provides a death benefit in case of premature death of the policyholder during the policy term. This amount is given to the nominee of the policy, allowing them to pay off any outstanding loan in your absence. While understanding what term insurance is, it is also important to know that it is one of the most affordable forms of life insurance, offering greater life cover at lower premium rates. Term insurance is considered an important financial product for long-term financial planning.It is important to understand why term insurance is important for everyone.

If you are the sole earner in your family, buying a term plan will take care of your family’s financial needs in your absence. In case of your untimely death, the insurance company will provide life cover to your nominee, helping them meet their financial needs. If you have taken a personal loan, education loan or home loan, paying these loans in your absence can be a burden on your family. The money in your term insurance plan will cover these loans, your family will not have to face these financial obligations.

As you age, the risk of lifestyle diseases increases. Some term insurance plans include protection against critical illnesses, protecting your family against unforeseen circumstances and providing financial security during your lifetime. To explain the meaning of the word insurance, this plan ensures that you are financially secure if you face serious health conditions like cancer or heart attack. Term insurance plans are better for those looking for great life cover at an affordable premium. With these plans, you get the flexibility and convenience to customize the plan as per your needs.

Different types of term insurance have different benefits, so you should always check their terms and conditions to better understand them. How much your dependents will need in case of unexpected death of the earner. Ideally, according to insurance experts, term insurance coverage should be at least 15 to 20 times your current annual income. Term insurance provides a straightforward and cost-effective way to secure your family’s financial future. It provides high life cover at a low premium, ensuring your loved ones are financially secure.

Term insurance plans are considered to be one of the best types of life insurance plans that you should buy these days. These plans provide many term insurance benefits, such as financial protection for your loved ones in case of unfortunate events, tax benefits and much more. Anyone between the ages of 18 to 65 can opt for term insurance. However, your 20s are a good time to get into the insurance market and plan for your family’s future.

Most people start their first job in their 20s and start earning a basic amount, with relatively little income and few expenses. The best time to buy life insurance if you want affordable coverage is generally before age 30, but that can vary based on a person’s health, budget, and reason for buying life insurance.