Forex trading, also known as foreign exchange trading, is a popular way to earn money online. It involves buying and selling currencies to make a profit. The forex market is the largest and most liquid financial market in the world.

It operates 24 hours a day, five days a week. Millions of traders from all over the world participate in it. If you are new to forex trading and want to know how to get started, this article will guide you through the basics. We will cover everything from opening a trading account to understanding market analysis.

What is Forex Trading?

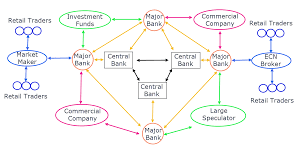

Forex trading is the exchange of one currency for another. For example, you can exchange US dollars (USD) for euros (EUR). These transactions happen in the forex market, where currencies are traded in pairs. The first currency in a pair is the base currency, and the second is the quote currency. The forex market is decentralized, meaning there is no central exchange. Instead, trading takes place through a network of banks, brokers, and financial institutions.

Key Concepts in Forex Trading

Before you start trading, you need to understand some key concepts:

Currency Pairs: In forex, currencies are always traded in pairs, like EUR/USD or GBP/JPY. The first currency is the base currency, and the second is the quote currency. The value of a currency pair is determined by how much of the quote currency is needed to buy one unit of the base currency.

Bid and Ask Price: The bid price is the price at which a trader can sell a currency, and the ask price is the price at which they can buy it. The difference between the bid and ask prices is called the spread. It represents the broker’s profit.

Leverage and Margin: Leverage allows traders to control a large position with a small amount of money. For example, a leverage of 1:100 means you can trade $100,000 with just $1,000. Margin is the amount of money needed to open a leveraged position. However, leverage can amplify both profits and losses.

Pips: A pip is the smallest price move that a currency pair can make. It is usually the fourth decimal point (0.0001) in currency pairs. In trading, profits and losses are calculated in pips.

Lot Size: A lot is the standard unit of measurement in forex trading. A standard lot is 100,000 units of the base currency. There are also mini lots (10,000 units) and micro lots (1,000 units). The lot size determines the risk and reward of a trade.

How to Start Forex Trading?

To start trading in the forex market, follow these steps:

Choose a Reliable Broker: The first step is to select a reliable forex broker. A broker provides you with a trading platform and access to the forex market. Look for a broker that is regulated, has low spreads, and offers good customer support. Read reviews and compare brokers before making a decision.

Open a Trading Account: Once you have chosen a broker, open a trading account. There are different types of accounts, such as standard, mini, and micro accounts. Choose an account type that matches your trading experience and risk tolerance. You will need to provide some personal information and verify your identity to open an account.

Deposit Funds: After opening an account, deposit funds into it. Most brokers offer various payment methods, such as bank transfers, credit cards, and e-wallets. Start with a small amount that you can afford to lose. Remember, forex trading is risky, and you should never trade with money you cannot afford to lose.

Use a Demo Account: Before trading with real money, practice on a demo account. A demo account allows you to trade with virtual money in real market conditions. It helps you understand how the trading platform works and allows you to test different strategies without any risk.

Learn Forex Basics: Educate yourself about the basics of forex trading. Learn about different trading strategies, technical analysis, and fundamental analysis. Read books, watch tutorials, and join online courses to enhance your knowledge.

Types of Forex Trading Strategies

There are several forex trading strategies. Choose one that suits your trading style:

Scalping: Scalping is a short-term trading strategy. It involves making multiple trades in a day to profit from small price movements. Scalpers need to act quickly and have a strong understanding of technical analysis.

Day Trading: In day trading, traders open and close positions within the same trading day. They do not hold positions overnight to avoid the risk of price gaps. Day traders rely on technical analysis and chart patterns to make decisions.

Swing Trading: Swing traders hold positions for several days to take advantage of market swings. They aim to capture medium-term price movements. Swing trading requires patience and the ability to analyze both technical and fundamental factors.

Position Trading: Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. They focus on fundamental analysis and long-term trends. This strategy requires a deep understanding of global economic factors.

Understanding Market Analysis

Market analysis is crucial for successful forex trading. There are two main types of analysis:

Technical Analysis: Technical analysis involves studying past price movements and patterns to predict future price movements. Traders use charts, indicators, and trend lines to make decisions. Some popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

Fundamental Analysis: Fundamental analysis focuses on economic, political, and social factors that affect currency values. It involves analyzing economic data such as GDP, inflation rates, employment figures, and interest rates. Traders must stay updated with global news and economic events.

Risk Management in Forex Trading

Forex trading involves a high level of risk. Therefore, managing risk is essential for long-term success. Here are some risk management tips:

Set Stop-Loss Orders: A stop-loss order automatically closes a trade when the price reaches a certain level. It helps minimize losses in case the market moves against you.

Use Proper Position Sizing: Never risk more than a small percentage of your trading account on a single trade. Proper position sizing helps you survive losing streaks and protects your capital.

Avoid Over-Leverage: High leverage can lead to significant losses. Use leverage cautiously and always be aware of the risks involved.

Stay Emotionally Balanced: Trading can be emotional. Fear and greed can lead to poor decision-making. Stick to your trading plan and avoid making impulsive trades.

Conclusion

Forex trading can be profitable, but it requires knowledge, discipline, and risk management. Start by learning the basics and practicing on a demo account. Choose a reliable broker and develop a trading plan that suits your style. Always stay updated with market news and economic data. Remember, forex trading is not a get-rich-quick scheme. It takes time, effort, and practice to become a successful trader.